The 7 days

Week Ahead:

Mon:

China manufacturing PMI, non-manufacturing PMI

Saylor expected to announce another BTC purchase

Singapore: Crypto exchanges serving only overseas customers to cease activities

Bybit to launch testnet for Byreal (its own Solana-based DEX)

ETHCC(June 30-July 3rd): fireside chat with Robinhood Crypto GM, vitalik, Offchain Labs at 7:45pm CEST (Something big is surfacing, expected(speculations) new l2, even tokenizes stocks)

Tue:

Fed Chair Powell Speech at 09:30 AM

ISM Manufacturing PMI

JOLTs Job Openings

‘K-Scale Labs’ to start shipping open-source Personal Robots at $8,999.

Wed:

Tesla expected to release Q2 vehicle sales figures

Vitalik's Annual EthCC talk

Thu:

Non Farm Payrolls

ISM Services PMI

U.S. Markets close early ahead of Independence Day

TBA/Whole Week:

TradeFi: Vote on Big Beautiful Bill(Advances in Senate, debate on tax cut bill, also Bessent asked Congress to drop Sec 899), another round of musk vs trump?, trade deals?, “Liberation Day” tariffs resume

Crypto: Continued discussion around crypto bills, Tokenization. U.S. House could vote on crypto legislation in July

What Happened:

Crypto:

Strategy acquired 245 bitcoin

A new crypto stablecoin ‘A7A5’ designed to allow cross-border payments in spite of western sanctions on Russia has moved some $9.3bn on a dedicated crypto exchange ‘Grinex’ in just four months since it was launched, the FT has found. A7A5 token also appears to be linked to Moscow’s attempts to use crypto to bankroll political influence campaigns abroad. Russian users can buy A7A5 tokens on the Tron or Ethereum blockchains and then use them to purchase Tether’s USDT, a US-dollar pegged stablecoin. From there, the user can withdraw the value in whichever country or currency they need.

The % of total ETH supply staked is now back near its ath, ETH validator entry queue has also exploded, A potential driver for this is speculation around a spot ETH staking ETF, with potential issuers seeding validators early: theblock

Singapore caught the crypto industry off guard in May, when it announced exchanges serving only overseas customers would have to close by June 30, unless they received a licence that is hard to attain. Bitget and Bybit relocating staff to Hong Kong and Dubai.

Marshall Wace Books $700m Gain on Circle’s Hot IPO, The fund participated in a $400m funding round for Circle, the issuer of USDC, in 2022.

Blockchain company Digital Asset Holdings has raised $135M from large financial firms including Citadel, Goldman Sachs. Digital Asset developed a public blockchain called Canton Network in 2023

A UAE-based crypto fund, purchased $100m of World Liberty Financial tokens, becoming the largest individual investor in the Trump-backed digital asset project.

REX-Osprey to launch SOL, ETH staking ETFs after resolving SEC comments.

South Korean investors have poured a net $443M into Circle shares, making it the most heavily purchased foreign security in June, It now ranks as the fourth most-bought overseas stock year-to-date.

Fiserv Launches New FIUSD Stablecoin for Financial Institutions.

EU’s executive arm, is planning to issue formal guidance proposing that stablecoins issued outside the bloc are treated as interchangeable with same-branded versions allowed only on EU markets.

BIS believes it would be better to create a centralised database of tokenised deposits of central banks and commercial banks to speed up and cut the cost of cross-border payments ‘instead of using stablecoins’. It is trialling such a system with seven major central banks and 43 commercial institutions, called Project Agorá.

Whatever Ethena is, and whatever it becomes, it’s unlikely to be boring: FT

Vitalik Buterin warns Sam Altman's World digital IDs risk killing pseudonymity online, Instead of a single ZK-wrapped “one-per-person ID” solution, Buterin suggests using a pluralistic model where no one person, institution or platform is in charge of issuing digital identities.

A team of crypto hedge fund executives are in advanced talks to raise $100 million for investing in BNB token through a publicly listed company they control. They plan to announce a $100 million BNB treasury strategy in the next month.

A new framework for token market transparency: Blockworks

Lido has voted in favor of a dual governance structure, giving stakers the power to delay or veto governance decisions made by LDO token holders: theblock

Chinese brokerage firm GF Securities launches offshore yuan-backed tokenized securities in Hong Kong: theblock

The crypto rich will soon be able to include their digital asset holdings as part of their wealth when seeking a home loan. Wednesday, the director of the FHFA, Pulte, told Fannie and Freddie, the mortgage giants, to bring proposals to consider digital asset wealth when making decisions about loans: Axios

‘Republic’ plans to sell digital tokens that mirror the performance of SpaceX’s private shares in a move largely untested with regulators. Token buyers won’t own actual stakes. “your sole counterparty is RepublicX LLC”. “unfortunately, because it is 2025, forwards are called tokens”: Matt Levine || Gemini launches tokenized stocks for EU traders, beginning with onchain representation of MSTR on Arbitrum

Tether’s Paolo Ardoino says Tether-backed brain-computer interface 'much more advanced' than Elon Musk's Neuralink: theblock

Deposit tokens are not a payments breakthrough, Proper money “can be issued by different banks and accepted by all without hesitation. Deposit tokens (JPMD) don’t have this property now, and it’s hard to see how that could change: FT

30% of bitcoin’s circulating supply is concentrated in 216 centralized entities: Gemini and Glassnode

Kraken is developing a financial services app called Krak, which will allow users to send and receive both crypto and traditional currencies across borders at little to no cost.

A former Blackstone dealmaker and a co-founder of Tether Holdings SA are raising $1 billion for a listed crypto vehicle to hold a diversified mix of digital assets, including Bitcoin, Ether, and Solana.

“I have to do something out of the box in order to get rich.” Millennials and Gen Z thinks, the system is rigged

Ripple Stuck With $125 Million Penalty as Judge Denies XRP Settlement With SEC: decrypt

At least nine London-listed companies, from a web design business to a gold miner, have in the past week announced that they have either bought bitcoin to add to their corporate treasuries or plan to do so.

98.6% of tokens launched on Pump.fun were rug pulls or pump and dump

schemes, according to a report by Solidus Labs.

MEV bots are clogging blockchains faster than networks can scale, says Flashbots

Crypto Venture Weekly

Galaxy Digital raises $175M in first fund to expand crypto investments

Zama becomes 1st fully homomorphic encryption unicorn with $57M raise.

Polymarket is in talks to raise $200m led by Founders Fund at a $1b valuation, Kalshi raised $185m at a valuation of $2b led by Paradigm, Other investors include Multicoin Capital, Sequoia Capital, Neo, and Citadel Securities CEO Peng Zhao.

Prediction market contracts are gambling or NOT?: Currently, Kalshi offers contracts only on the results of games or tournaments, but the NBA wrote to the CFTC that it is concerned that the market will soon expand to individual player propositions or other types of contracts that pose a greater threat to sporting integrity. It also said that the self-certification process "allows most contract markets to simply proceed unchecked.": Matt Levine

In the Trump administration, more or less anything goes, crypto-wise, so you can go ahead and raise money for crypto projects by issuing tokens without worrying about registration or disclosure or fraud liability. (Not legal advice!) The first problem is solved. That doesn’t help with the second problem, though. Arguably it makes it worse: Matt Levine

Start a crypto project, with tokens, MattCoin or whatever.

Sell the tokens to anyone who wants them, but keep a lot for yourself.

Put your tokens in a corporate box, and give the box the name of your crypto project. “MattCoin Inc.”

Issue shares of the box: regular shares, on the stock exchange, with disclosure, in an ordinary initial public offering. (treasury company)

TradeFi:

Majority of Fed Officials Leaning Against July Interest-Rate Cut: Waller and Bowman signaled they’d be open to lowering rates as soon as the Fed’s July 29-30 meeting if inflation remains contained but Powell, Williams, Kashkari and Daly — have dumped cold water on that idea. Most of FOMC Seems More Hawkish Ahead of July Meeting.

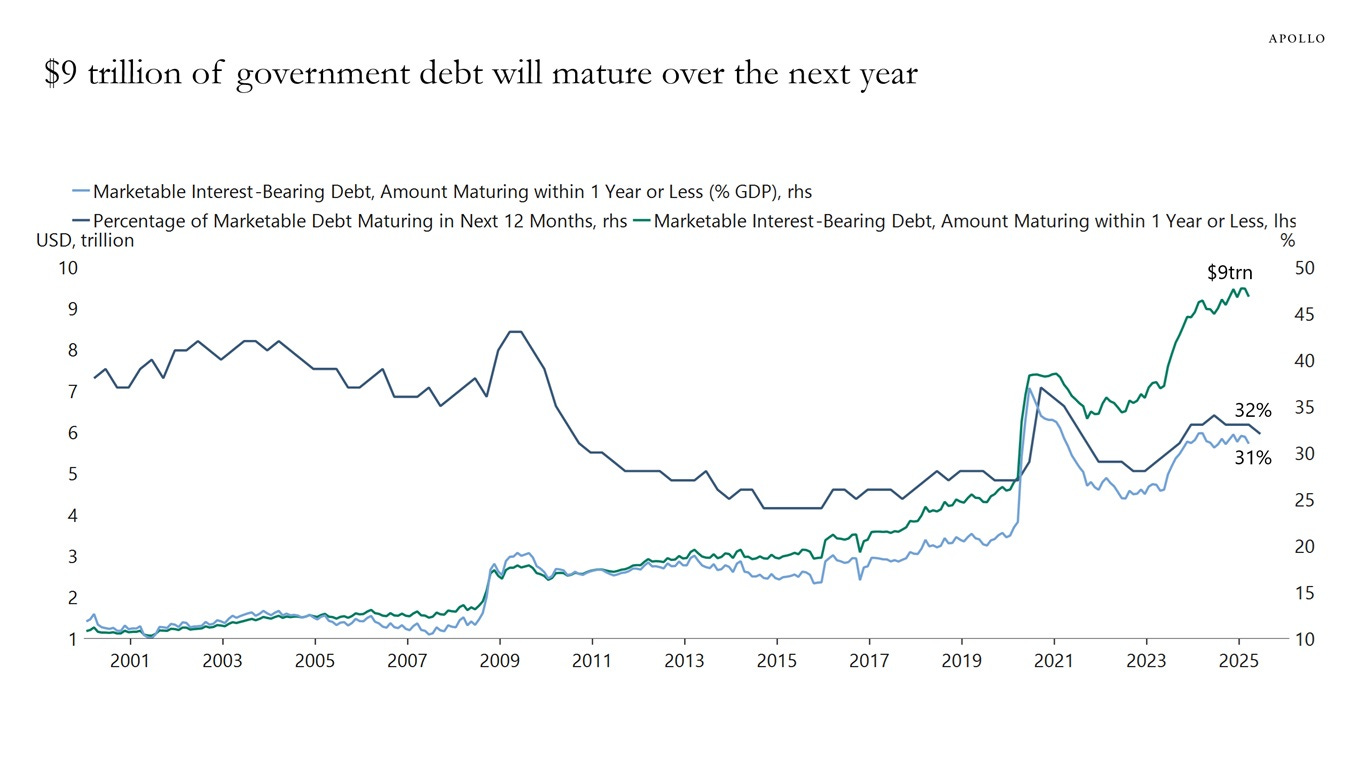

Fed independence?: Trump on Powell: He’s a stupid person— stubborn mule…I've instructed my people not to do any debt beyond nine months or so. Get this guy out.. if I think somebody's going to keep the rates where they are, or whatever, I'm not going to put them in. I'm going to put somebody that wants to cut rates. There are a lot of them out there”. Bessent, Hassett & Waller are under consideration per some reports. Bessent told CNBC “There is a chance that the person who is going to become the chair could be appointed in January, which would probably mean an October, November nomination.”

*3 weeks ago, Trump was calling on the Fed cut the funds rate 100 bps, Last week Fed should cut 200 to 300 bps, on weekend he says the funds rate should be 1% (350 bps cut). Right on track to get him to demand negative interest rates somewhere after July 4th: Bianco

“The lack of gratitude of this nation to Powell is insane. One of the greatest Fed chairs in history, Powell could be the last non-political Fed chair”: Steve Hou

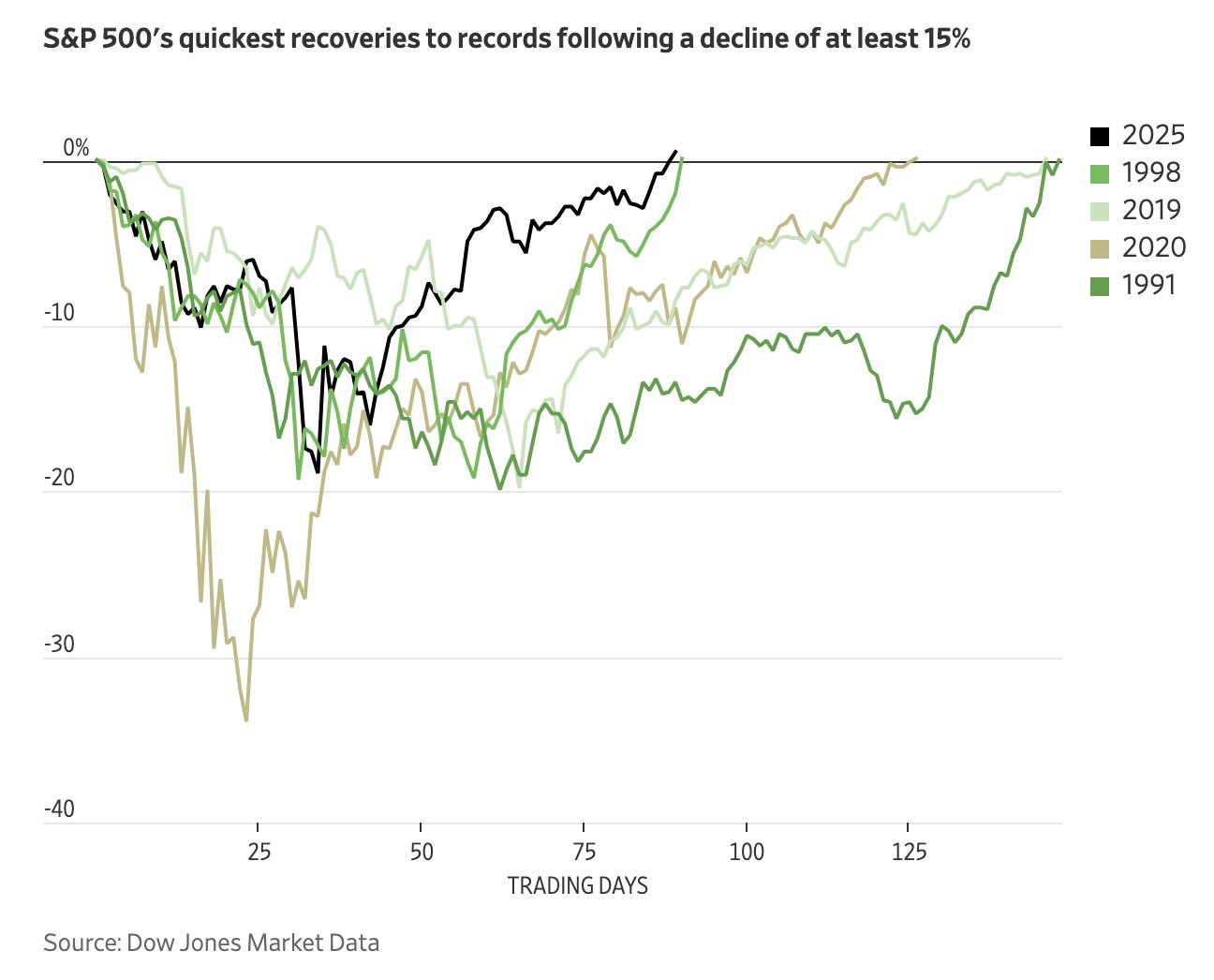

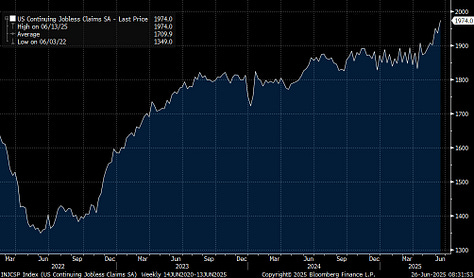

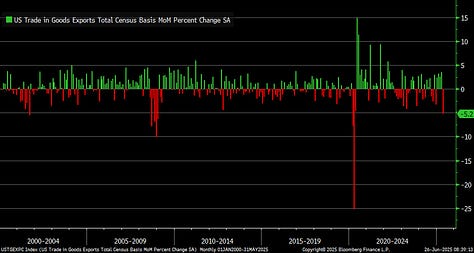

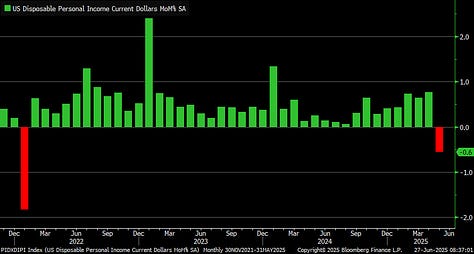

Soft Data Rebounding, Hard Data Softening

Soft and hard data have converged. Direction now will determine if recession or recovery: zerohedge

U.S. Existing-Home Sales See Weakest May Since 2009 & other data dump of last week:

Cost of hedging against a 10% QQQ drop is highest since April 9

The survey showed the net underweight position in the dollar is the largest in 20 years. What's more, "short dollar" had found its way into the top three "most crowded trades" on the planet according to investors. That was just behind "long gold" and "long Magnificent 7" megacap stocks. Often seen as a contrarian indicator, crowded trades typically signal an extreme and potentially over-priced move. But history shows that certain trades can stay crowded for quite some time.

“We can do whatever we want. We could extend it, we could make it shorter,” Trump said. “I’d like to make it shorter. I’d like to just sent letters out to everybody, ‘Congratulations, you’re paying 25%.’” Trump's self-imposed tariffs deadline approaching, trade talks with major partners are struggling to reach agreements, with only the UK securing a deal that keeps the 10% reciprocal rate in place. Trump said he's not planning to extend a pause on tariffs beyond July 9, “could send letters setting tariff rates rather than extend deadline”, while Bessent signaled there may be some extensions to wrap up major pacts by the Labor Day holiday. “POWELL SAID FUTURE TRADE DEALS "MAY "ALLOW FED TO CONSIDER CUT”

EU: best-case scenario agreement on principles that would allow the negotiations to continue beyond July, MORE

The value of small parcels sent from China to the US fell to just over $1b in May, the least since early 2023, 40% plunge from the same month last year.

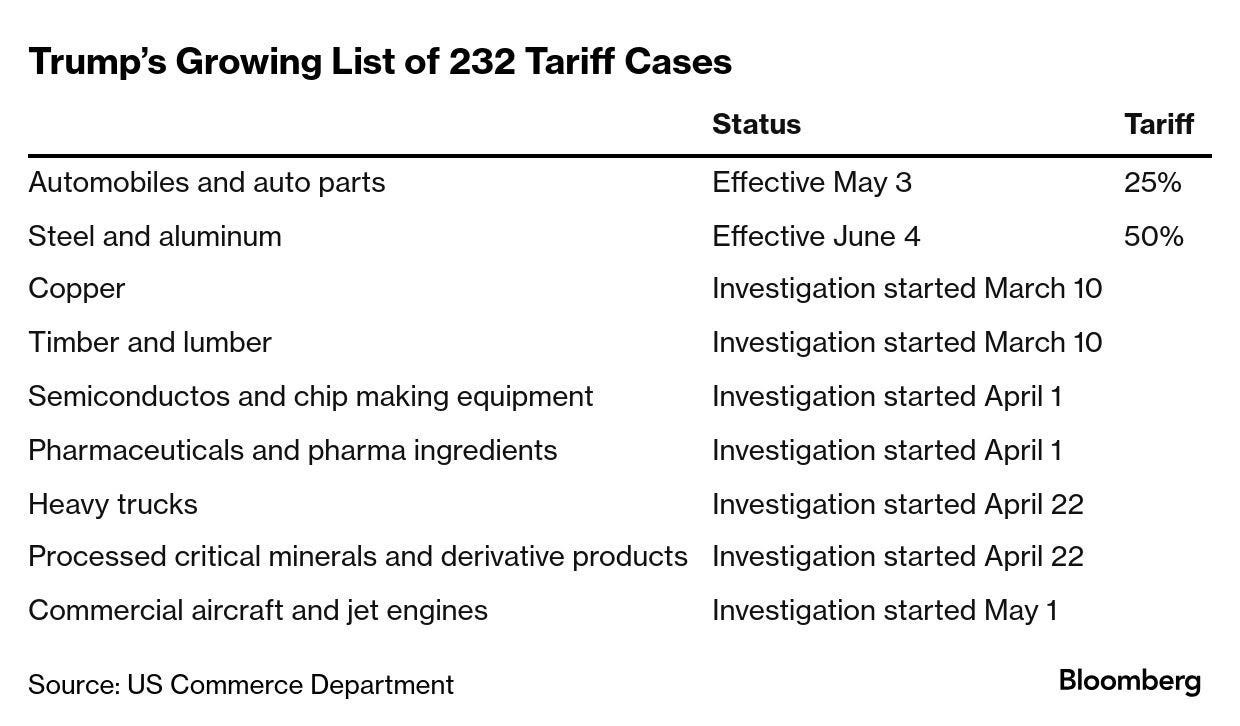

The US Commerce Department is set within weeks to announce the outcomes of self-described investigations into sectors deemed vital to national security, including semiconductors, pharmaceuticals and critical minerals. The inquiries are widely expected to result in tariffs.

The Federal Reserve has removed "reputational risk" from its manuals explaining how its staff should assess the soundness of banks. This change does not alter the Board's expectation that banks maintain strong risk management to ensure safety and soundness and compliance with law and regulation.

Jane Street Boss Says He Was Duped Into Funding AK-47s for Coup

China Opens First Offshore Gold Vault and Contracts in Hong Kong

China’s $1.3 trillion sovereign wealth fund is reducing its exposure to US private assets.

Russian banking officials warn of a credible risk of a systemic banking crisis in the next 12 months due to a growing number of corporate and retail clients failing to make loan payments. Bad debt on Russian banks’ balance sheets is estimated to be in the trillions of rubles, with borrowers deferring payments, and the true magnitude of the debt problem may be masked by official figures.

Gold has overtaken the euro as the second-largest asset in central banks' reserves, with a 20% share at market prices, surpassing the euro's 16% share.

Tech:

Mark Zuckerberg’s New Superintelligence Team to achieve AGI: Alexandr Wang(Scale AI), Daniel Gross(SSI), Nat Friedman(GitHub), OpenAI’s elite researchers (Trapit Bansal, Lucas Beyer, Alexander Kolesnikov, Xiaohua Zhai, Jiahui Yu, Shuchao Bi, Shengjia Zhao, Hongyu Ren), Jack Rae(DeepMind), Johan Schalkwyk(Sesame),

*This month alone Meta tried to poach more than 45 AI researchers from OpenAI, Some received formal offers, with at least one as high as $100M, Meta unsuccessfully tried to poach Koray Kavukcuoglu, one of Google’s top AI researchers, as well as Noam Brown , a leading researcher at OpenAI.

*Zuckerberg reportedly even tried to acquire startups such as Sutskever’s Safe Superintelligence, Mira Murati’s Thinking Machines Labs, and Perplexity.

Things are so bad between Microsoft & OpenAI, executives are close to “accusing Microsoft of anticompetitive behavior during their partnership,”. Google Convinced OpenAI to Use TPU Chips in Win Against Nvidia. This shows the Altman shifting away from relying on Microsoft's data centers.

Meta is also considering leasing Google's TPUs per The Information

Deepseek progress has stalled due to Nvidia chip shortage, DeepSeek's highly anticipated upcoming large language model, R2 delayed

A 25-year-old British man known as “IntelBroker” was accused by US authorities of conspiring to steal data from dozens of companies and offer it for sale online, while four others were arrested in France for allegedly running the online hacker forum ‘BreachForums’ he frequented.

Gemini CLI; AlphaGenome: AI for better understanding the genome

China could generate over 100 DeepSeek-like breakthroughs in artificial intelligence in the next 18 months, a development that “will fundamentally change” the Chinese economy, according to Zhu Min, a former deputy governor of the People’s Bank of China

Microsoft reportedly laying off thousands more, especially in sales. The company had 228k workers at the end of June 2024, 45k of them in sales and marketing.

AI: AI Cannibals Eat Into $20 Billion Music Market;; Silicon Valley’s ‘Tiny Team’ Era Is Here

Investors are underestimating Waymo's potential and overestimating Tesla's, with Waymo already operating and having deals with OEMs, while Tesla's rich valuation depends on rapid adoption of its robotaxi service.

Apple Executives Have Held Internal Talks About Buying Perplexity

xAI is burning through $1 billion a month, with expected losses of $13 billion in 2025

Musk-Tesla Mess?: Tesla paused Model Y & Cybertruck production for the second time in two months;; Afshar, a powerful executive at Tesla and one of Musk’s closest confidants, left the company;; few weeks ago Milan Kovac, the head of engineering for the company’s Optimus humanoid robot program, stepped down;; Afshar & Whole Mars Catalog will be starting a new company together?;; Jenna Ferrua, human resources director for North America, has also left Tesla;; Musk slammed US Senate’s latest version of Trump’s tax bill Saturday, “incredibly destructive” to the country. Bill is political suicide for the Republican Party. Xiaomi launched YU7, undercutting Tesla's Model Y on price, orders hit 200k in 3 minutes, range of up to 835 km, compares with up to 719 km for Model Y, EV tax credit are at risk as well…Also Tesla Sales Plunging in EU & China

Jensen Huang on quantum computing: “Just like Moore’s Law, I could totally expect 10 times more logical qubits every five years, 100 times more logical qubits every 10 years.”

Other:

You can make jet fuel from palm oil. It doesn’t even need to be fresh. You can take palm oil, put it in a deep fryer, use it to make french fries, reuse it again and again until it becomes gross and the fries taste bad, and then take the used oil and sell it to a refiner to make jet fuel: Matt Levine

Researchers have discovered why some people with attention deficit hyperactivity disorder may do well on their medicine for a while but struggle down the road: Why Some Generics Fail to Work, The researchers also found that seven of the 15 immediate-release tablets of methylphenidate they tested contained high levels of a likely carcinogen

TIME100 Most Influential Companies 2025

Warren Buffett donates record $6 billion Berkshire shares

Khamenei is 86 Putin is 72 Xi Jinping is 72 Netanyahu is 75 Trump is 79 There will be seismic political shifts over the next decade or so: Maguire

Like everyone else you are also looking for some Robot Companies? if yes then check this:

Top Robotics Companies Transforming the Industry in 2025

ETH is not digital oil. Oil is just oil — Donovan