The 7 days

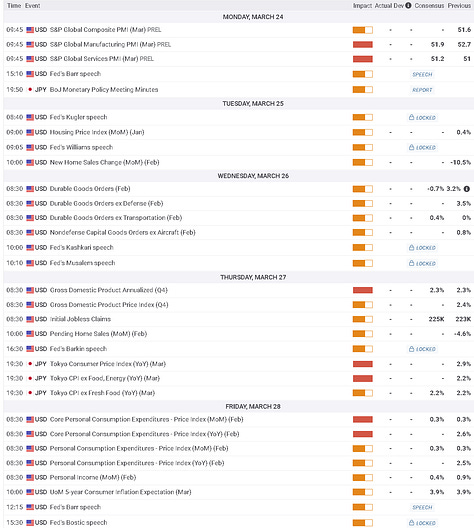

The Week Ahead:

Reads:

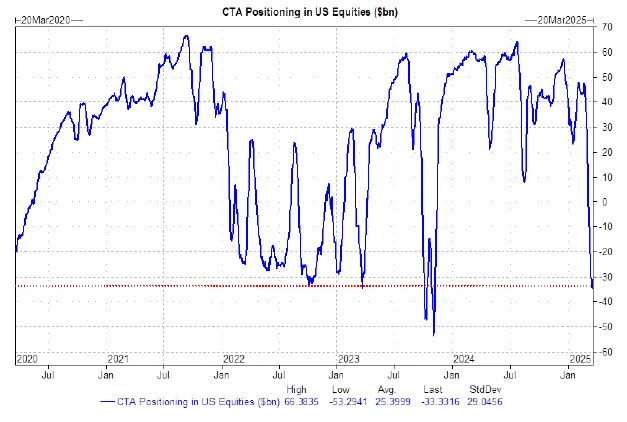

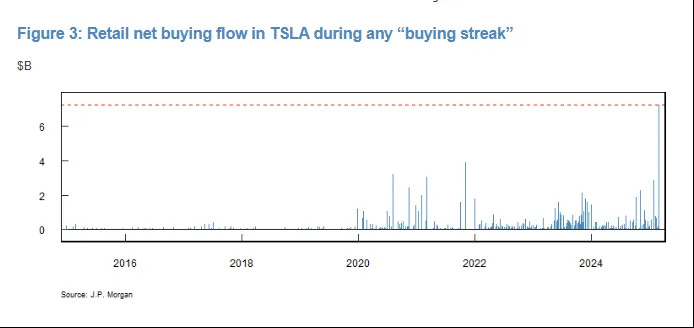

WEN BOTTOM?: In a correction, on average the market takes five months to fall from peak to bottom, then four months to bounce back, per Clearnomics data shared by Covenant Wealth Advisors: Axios || Retail investors have pumped over $12 billion into US equities in a single week, a pace significantly higher than their 12-month average. Market watchers keep a close eye on retail traders as they are often the last to cut their exposure to stocks, so the latest bout of aggressive buying from mom-and-pop investors may suggest that equities haven’t found the bottom yet: BBG || Goldman traders wrote in a note to clients Thursday. A sizeable rally would unlock almost $70 billion of US equity buying, but we are not there yet, they added. They expect CTAs will turn into short-term buyers when the index reaches 5,870, or around 4% above Friday levels. The index currently sits at around 5,636, some 8% below its Feb. 19 all-time high: BBG

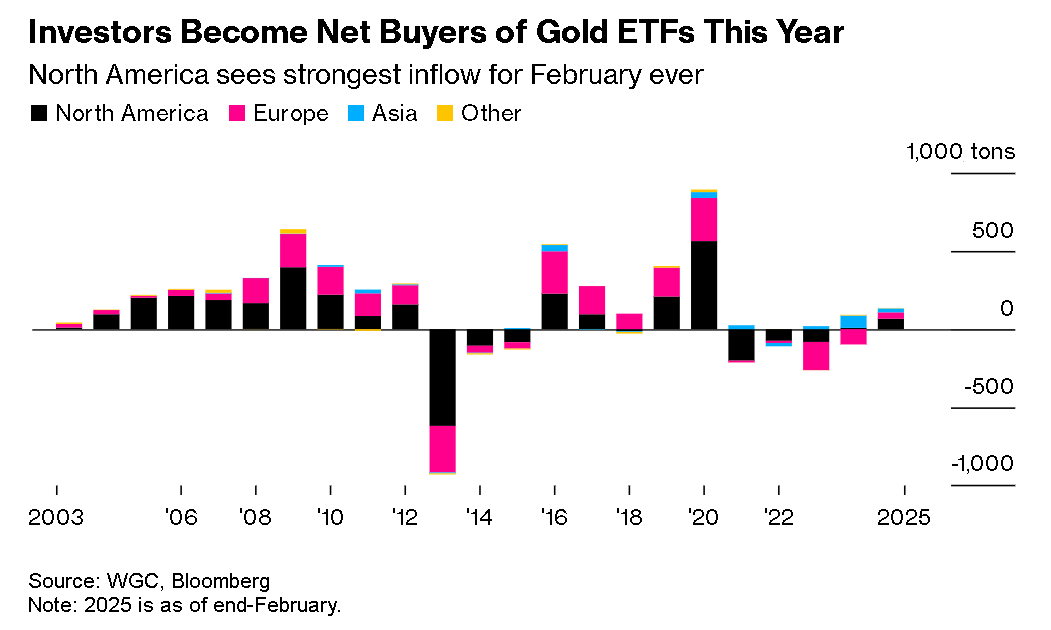

Gold: Investors are net buyers of physically-backed gold exchange-traded funds this year, after selling them for the past four years. North America saw a major inflow in February, the largest in a single month since July 2020: BBG

Silver: Comex-tallied inventories of silver have expanded to the highest level ever in data going back to 1992 after surging by 40% so far this quarter, a record rise. “I expect the lease rate in London to remain high for about two to three months,” said Cao Shanshan, an analyst at COFCO Futures Co. With the UK-to-US transfer under way, “silver is a lot bulkier than gold, so the transfer of silver will likely take longer,” she said. The US imports about 70% of its silver from Canada and Mexico:BBG

Money funds in February increased their repo holdings by $121 billion to a record $2.5 trillion: BBG

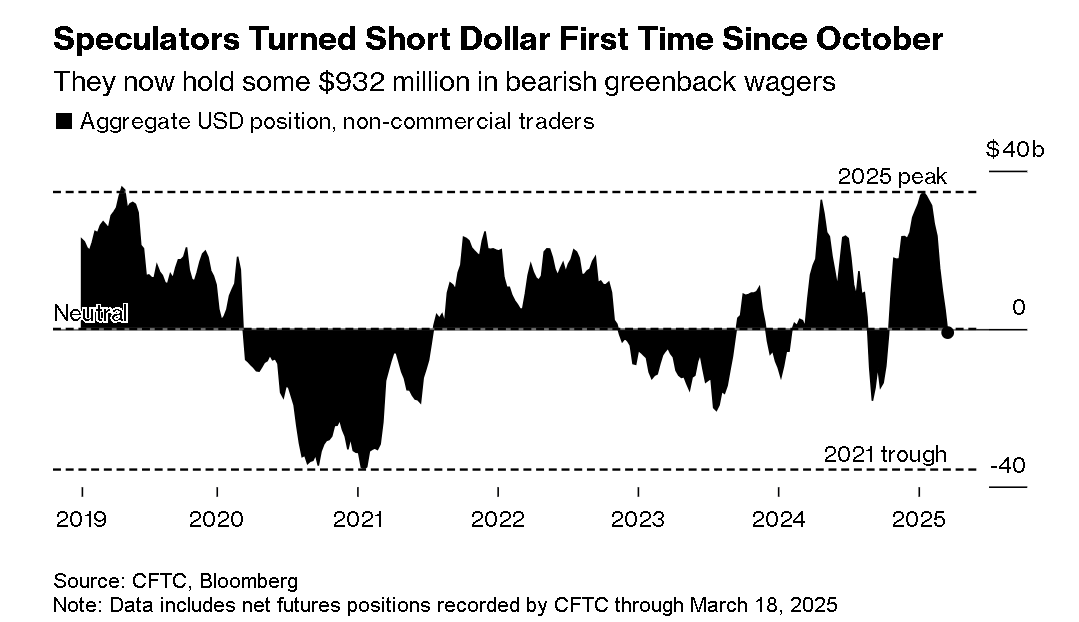

DOLLAR: Traders Bet on Weaker US Dollar for First Time Since Trump’s Win: BBG

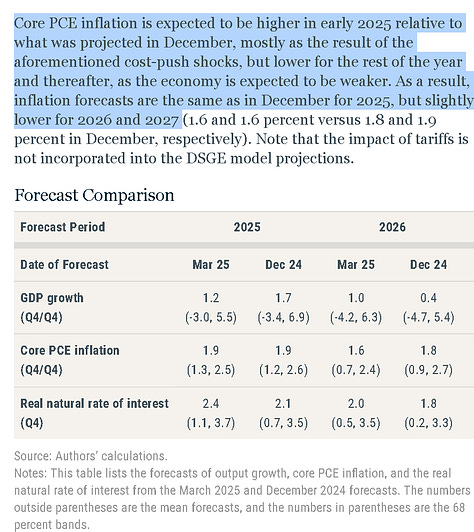

QT?: “Waller’s dissent (Fed’s Waller Sees No Evidence Reserves Are Nearing ‘Ample Level’) on QT is notable and suggests some mixed opinions on balance sheet policy,” said Gennadiy Goldberg, head of US interest rate strategy at TD Securities. “The reason they moved the Treasury QT cap lower to just $5 billion is so they are able to re-accelerate the pace of runoff after the debt ceiling is resolved. It’s easier to re-accelerate the pace when the cap is already non-zero.”

The longer it takes Congress to either suspend or lift the limit, the more cash that will make its way back into the financial system. That has the potential to artificially boost reserves — currently $3.46 trillion — masking money-market signals that could indicate when is the right time to stop QT: BBG What the Strategists Say about QT?: BBG (check link)

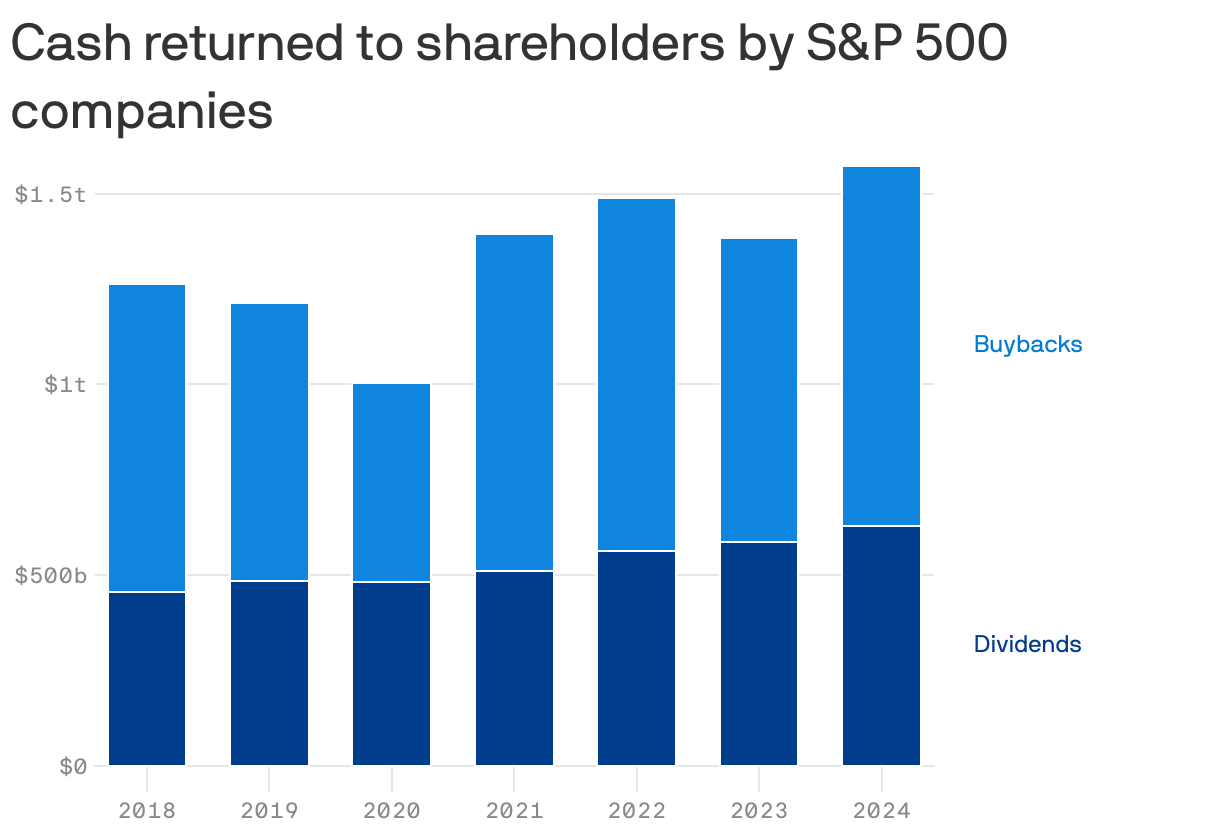

The 20 largest U.S. stocks represent $24 trillion in market cap — close to the total of the 480 other stocks in the S&P 500 ($29.8T) as well as the entire U.S. economy, measured at $27T in GDP in 2023:link || S&P 500 companies returned a record $1.6 trillion to shareholders in 2024, per S&P Dow Jones Indices, three-fifths of which was in the form of buybacks. The $1.6 trillion works out to just 3.2% of S&P 500 earnings, down from 4.6% in 2022 and 6% in 2018: Axios

.

The S&P 500 is entering “one of its most reliably favorable periods of the year,” according to SentimentTrader. The S&P 500 has posted an average gain of 3.9% from the 49th to the 75th trading day of the year around 70% of the time, in data going back to 1953, the research firm’s analysis shows. For 2025, this period extends from the close of March 14 through April 22: BBG

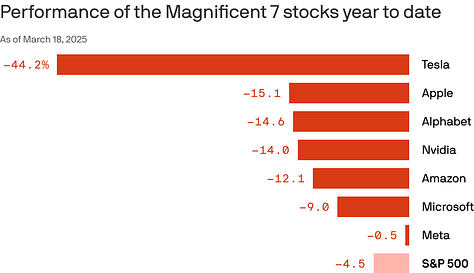

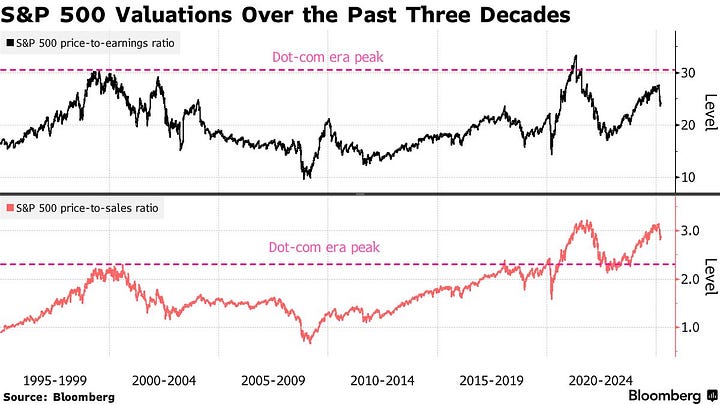

Stumbling Stock Market Raises Specter of Dot-Com Era Reckoning: BBG

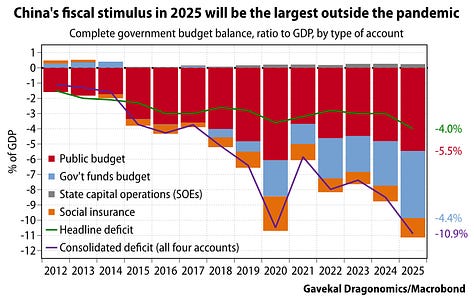

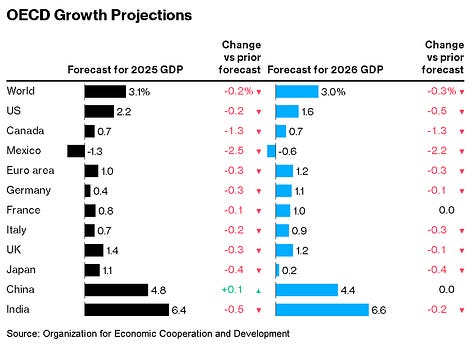

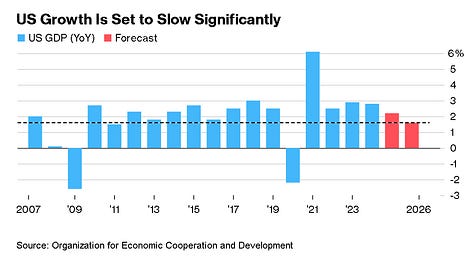

The OECD predicts the pace of global expansion to slow to 3.1% this year and 3% in 2026 due to trade barriers and uncertainty. The calculations don’t account for any of the other threats Trump has made, including a pledge of global reciprocal tariffs: BBG

Jerome Powell Says Trump Can’t Fire Him. That Might Change: BBG

CME traders show 'little interest' in Solana futures debut: theblock

CME futures Vol: week avg.

BTC: ~$5.5B

ETH: ~$1.1B

SOL: ~$12M

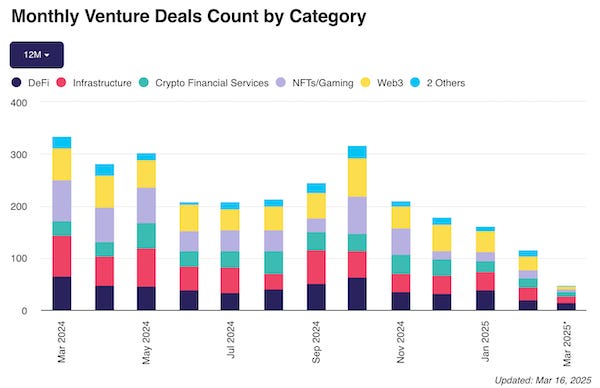

Funding: The monthly count of crypto venture deals has contracted significantly, with only 116 private deals tracked in February 2025, marking one of the lowest points in recent years. This represents a substantial decline from the 300+ deals recorded in October 2024 - a 60% drop within a 5-month period.: Theblock

Market Manipulation in DeFi by kaiko: Last week, data revealed that market manipulation still occurs on Uniswap, specifically through so-called sandwich attacks, involves an attacker placing a buy order before a trader's transaction and a sell order immediately after—all within the same block—to manipulate the price for personal gain. In this case, on a USDC-USDT liquidity pool on Uniswap V3 on Ethereum, a user attempted to swap 220.8k USDC for USDT. Just before the transaction was executed, an attacker sold nearly 20M USDC for USDT, drastically dropping the USDC's price to 0.024 USDT for 1 USDC, due to reduced liquidity and increased slippage in the pool. As a result, the user's swap was executed at an unfavorable rate, receiving only 5.3k USDT instead of the expected 220.8k USDT, resulting in a loss of 215.5k USDT. The attacker then repurchased the USDC at the lower price, within the same block, securing a profit even after paying a $200k tip to a block builder to prioritize their transaction.

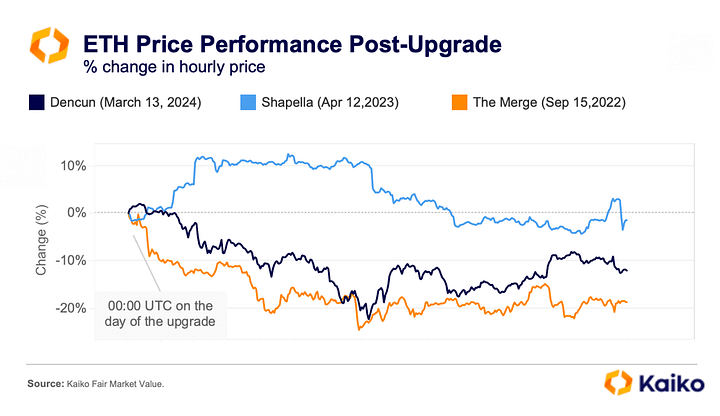

Will Pectra be enough to turn the tide for ETH? by kaiko: Over the past years, ETH has undergone several major upgrades without a hitch showcasing the network’s ability to evolve despite its growing size and complexity. However, none of them were a major price booster. In fact, most were “sell the news type of events” with prices down by 12% and 18% in the two-week period after Dencun and The Merge. Sophisticated traders are bearish for post upgrade period, with implied volatility skewing to the left. The largest skew is around the April 4 expiration, right around the time Pectra is expected to be on mainnet, and suggests large demand for hedging around this time. (upcoming Pectra upgrade is the largest in terms of EIPs)

Hidden Road, a prime brokerage focusing on cryptocurrencies and foreign exchange, is considering options including a sale or capital raise that could value the company at over $1 billion. Hidden Road raised $50 million in a Series A funding round that included Ken Griffin’s market-making firm Citadel Securities and crypto firms including Coinbase Ventures and Wintermute: BBG

Walrus Foundation raises $140 million from Standard Crypto and a16z for a high speed storage network: link

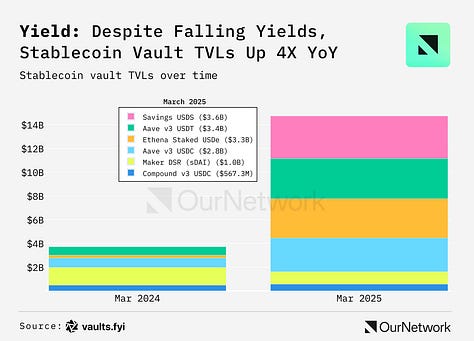

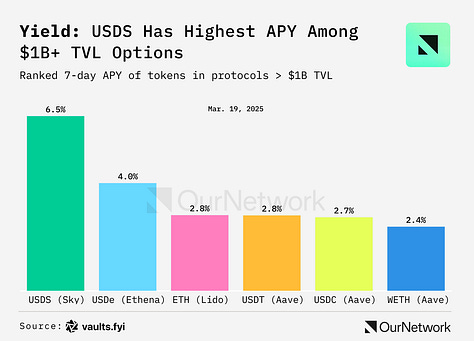

DeFi:Yields across leading DeFi protocols have dropped sharply BUT Activity in the largest stablecoin markets continues to grow however, even as rates fall.: OurNetwork

5 Ideas Pitched at the White House Crypto Summit Behind Closed Doors: unchainedcrypto

Cryptocurrency’s Role in the Global Fentanyl Trade Offers Opportunities for Disruption: chainalysis

Cosmos’ Interchain Foundation open-sourced Evmos as the native EVM framework for its ecosystem. This means EVM will become part of the official Interchain software stack, including Cosmos SDK: Theblock

Health: What to Know About Food Dyes After Red No. 3 Was Banned? The science on the other common food dyes — Blue 1, Blue 2, Green 3, Red 40, Yellow 5 and Yellow 6 — is less definitive, but strong enough for the European Union and California to regulate their use. In 2022, European regulators banned the use of titanium dioxide, a chemical that whitens foods, brightens colors and makes candy appear shiny, as a food additive. The ban followed a European Food Safety Commission opinion that nanoparticles of the substance might accumulate in the body, raising concerns about DNA damage: BBG || RFK Jr.’s Next Targets Are Companies Making Baby Formula: BBG

Nvidia CEO Huang says he was wrong about timeline for quantum, surprised his comments hurt stocks: CNBC

DeepSeek moment for electric vehicles? BYD unveiled a new EV platform that can be recharged about as fast as it takes refuel a gasoline car: Axios

Alphabet's largest-ever acquisition: Google has agreed to acquire Israeli cloud security Startup Wiz for $32 billion in cash: WHY

Charts dump: